Maximize Your Dental Insurance Benefits: A Complete Guide (2025)

Dental insurance can be a game-changer when it comes to maintaining oral health without draining your wallet. Yet, many people don’t fully understand their plan or fail to use all the dental insurance benefits available to them. If you’ve ever wondered how to make the most of your dental insurance benefits, you’re not alone! Understanding your dental insurance benefits is essential for maximizing value.

This guide will break down how dental insurance works and provide practical tips to save money and prioritize your oral health by maximizing your dental insurance benefits. Knowing the dental insurance benefits you have can help you make better choices about your care.

Why Understanding Dental Insurance Matters

Have you ever skipped a dental check-up because you weren’t sure what your insurance covered? Or rushed to schedule appointments in December, only to find it impossible to get in?

These are common scenarios, but with a little planning, you can avoid the stress and ensure you’re maximizing your benefits. Most plans follow a yearly cycle, meaning benefits reset every January 1st. If you don’t use them, you lose them!

Here’s the good news: with the right strategy, you can make your dental insurance work harder for you while maintaining a healthy smile.

Maximizing your dental insurance benefits can lead to significant savings and improved oral health. It’s crucial to be proactive in understanding your plan’s specific dental insurance benefits.

1. Know Your Plan’s Structure

Understanding how your plan works is the first step to getting the most out of your benefits.

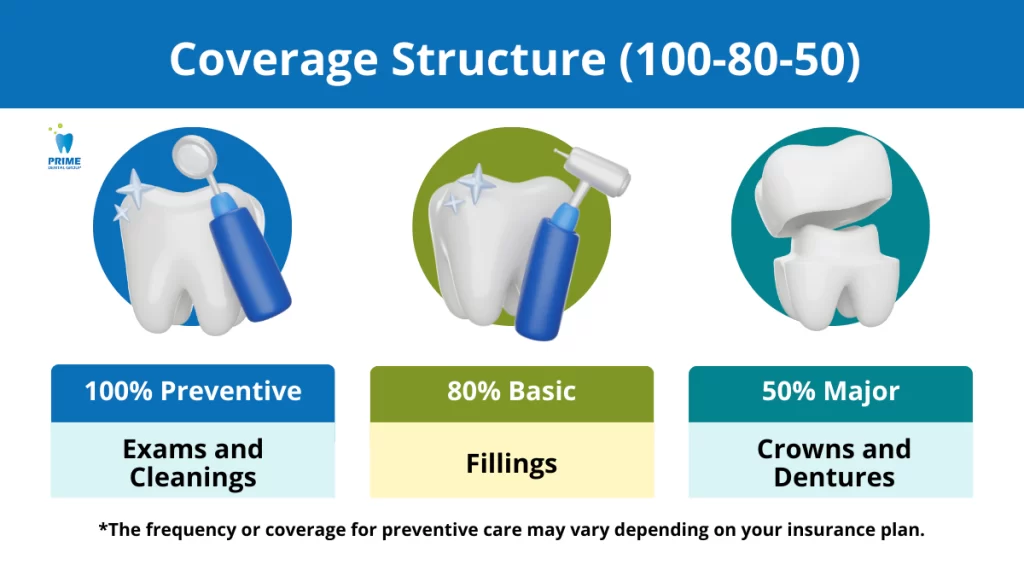

- Coverage Levels (100-80-50):

Many plans follow this structure:- 100% coverage for preventive care like cleanings and exams.

- 80% coverage for basic treatments like fillings.

- 50% coverage for major procedures like crowns or dentures.

- Annual Maximums:

This is the maximum amount your insurance will pay for treatments in a year, typically between $1,000 and $2,000. - Deductibles:

This is the amount you must pay out-of-pocket before your insurance kicks in. Most plans have a deductible of $50–$100.

When you understand your dental insurance benefits, you can make informed decisions that help prevent serious health issues and save money in the long run.

By understanding these basics, you can prioritize treatments and avoid unexpected costs.

Investing time to learn about your dental insurance benefits will pay off, making it easier to utilize services that keep your smile healthy.

2. Prioritize Preventive Care

Preventive care is not only essential for maintaining oral health, but it’s also often fully covered by insurance. Regular check-ups and cleanings can prevent small issues from becoming big problems.

Commonly Covered Preventive Services:

- Twice-yearly cleanings and exams.

- Routine X-rays.

- Fluoride treatments and dental sealants (especially for kids).

Tip: Schedule your preventive visits early in the year so you have time to address any additional treatment needs before your benefits reset.

3. Plan Major Treatments Strategically

If you need major dental work, timing is everything. Many insurance plans have an annual maximum, but you can split treatments across two calendar years to maximize benefits.

For example:

- Start a crown procedure in December and complete it in January. This lets you use your benefits from two years.

- Discuss treatment plans with your dentist to align them with your insurance cycle.

In-network providers typically maximize your dental insurance benefits, so consider this when selecting your dentist.

Pro Tip: Always request a pre-treatment estimate from your dentist. This document shows what your insurance will cover and helps you budget for out-of-pocket expenses.

4. Use In-Network Providers

Dentists in your insurance network have pre-negotiated rates, which means lower costs for you. Out-of-network providers may charge higher fees, and your insurance might not cover as much.

Benefits of Choosing In-Network Providers:

- Lower copays and coinsurance.

- Easier claims processing.

- Predictable costs for common procedures.

Be mindful of how your dental insurance benefits can work alongside your FSA or HSA to cover costs effectively.

Not sure if your dentist is in-network? Check your insurance company’s website or call their customer service line.

5. Don’t Let Your FSA or HSA Go to Waste

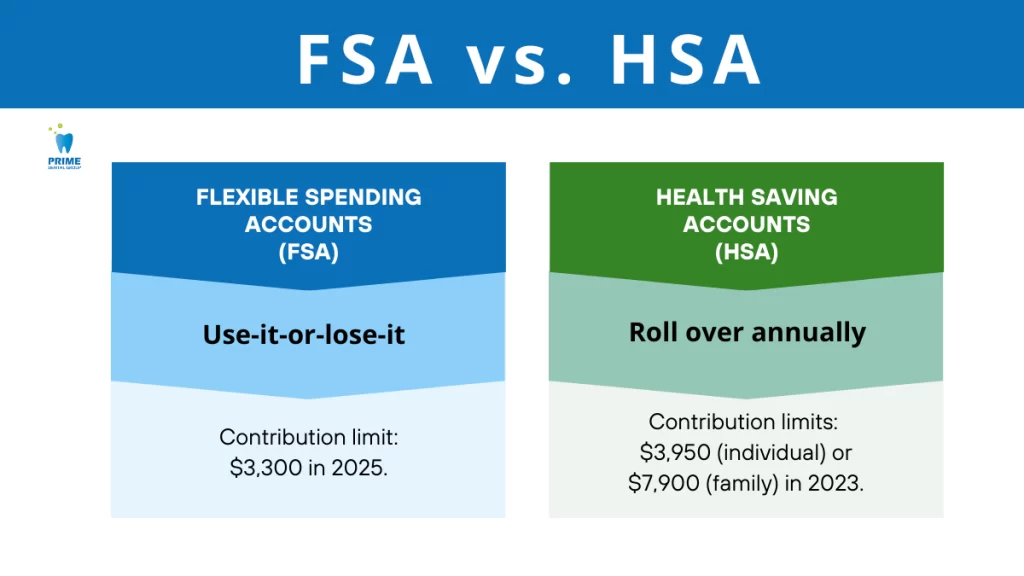

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are excellent tools for covering dental expenses, but they work a little differently.

- FSAs:

- Use-it-or-lose-it policy—funds typically expire at year-end.

- Contribution limit: $3,300 in 2025.

- HSAs:

- Unused funds roll over annually, making them ideal for long-term planning.

- Contribution limits: $4,300 (individual) or $8,550 (family) in 2025.

Tip: If you have an FSA, schedule any needed treatments before December 31st to avoid losing those funds!

6. Year-End Strategies for Maximizing Benefits

As the year comes to a close, it’s the perfect time to review your dental insurance and plan any last-minute appointments.

Tracking your dental insurance benefits and appointments ensures you don’t miss out on crucial care.

To maximize your dental insurance benefits, regularly monitor your plan’s terms and conditions to stay informed.

Smart Year-End Moves:

- Check your remaining annual maximum—schedule treatments before it resets.

- If you’ve met your deductible, complete any pending procedures now to save money.

- Use up FSA funds to cover out-of-pocket expenses.

By staying proactive, you can avoid the December appointment rush and get the care you need.

With the right knowledge and approach, your dental insurance benefits can significantly impact your experience with dental care.

Effective management of your dental insurance benefits can provide peace of mind regarding your oral health care strategy.

Actionable Tips for Maximizing Dental Insurance Benefits

Here are five simple steps to take today:

- Review Your Plan: Understand your coverage, maximums, and deductible.

- Schedule Preventive Care: Book your cleanings and check-ups early in the year.

- Plan Major Treatments: Spread costly procedures across two years if needed.

- Use In-Network Dentists: Save on out-of-pocket costs by sticking to your network.

- Track FSA/HSA Funds: Use them strategically to pay for eligible dental expenses.

Conclusion

Dental insurance is a valuable tool for maintaining your oral health while keeping costs manageable. By understanding your plan and staying proactive, you can maximize your benefits and avoid surprises.

If it’s been a while since your last visit, now is the perfect time to prioritize your smile! Bellevue Prime Dental Group and Lynnwood Prime Dental Group are here to help you every step of the way.

Call us today to schedule your appointment:

- Bellevue Prime Dental Group: (425) 605-3575

- Lynnwood Prime Dental Group: (425) 251-0707

Understanding the specifics of your dental insurance benefits can empower you to seek necessary services without hesitation.

Taking the initiative to learn about your dental insurance benefits is crucial in maintaining optimal oral health.

Your oral health deserves the best care—and we’re here to provide it!

FAQ

1. What does 100-80-50 coverage mean?

It refers to the percentage your insurance pays: 100% for preventive care, 80% for basic procedures, and 50% for major treatments.

2. What happens if I don’t use my dental benefits by year-end?

Most insurance plans reset on January 1st, meaning unused benefits are lost.

3. Can I use dental insurance for cosmetic procedures?

Cosmetic treatments like teeth whitening are typically not covered, but check your plan for specific exclusions.

4. What’s the difference between FSAs and HSAs?

FSAs expire at the end of the year, while HSA funds roll over and can grow over time.

5. How do I find an in-network dentist?

Visit your insurance provider’s website or contact their customer service for a list of in-network providers.

Take control of your dental health today—schedule your appointment and make the most of your insurance benefits!